Gift And Estate Tax Exemption 2025

Gift And Estate Tax Exemption 2025. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayer’s lifetime exemption. Spouses can elect to “split” gifts,.

Budget 2025 income tax expectations: A higher exemption means more estates may be exempt from the federal tax this year, which can save heirs.

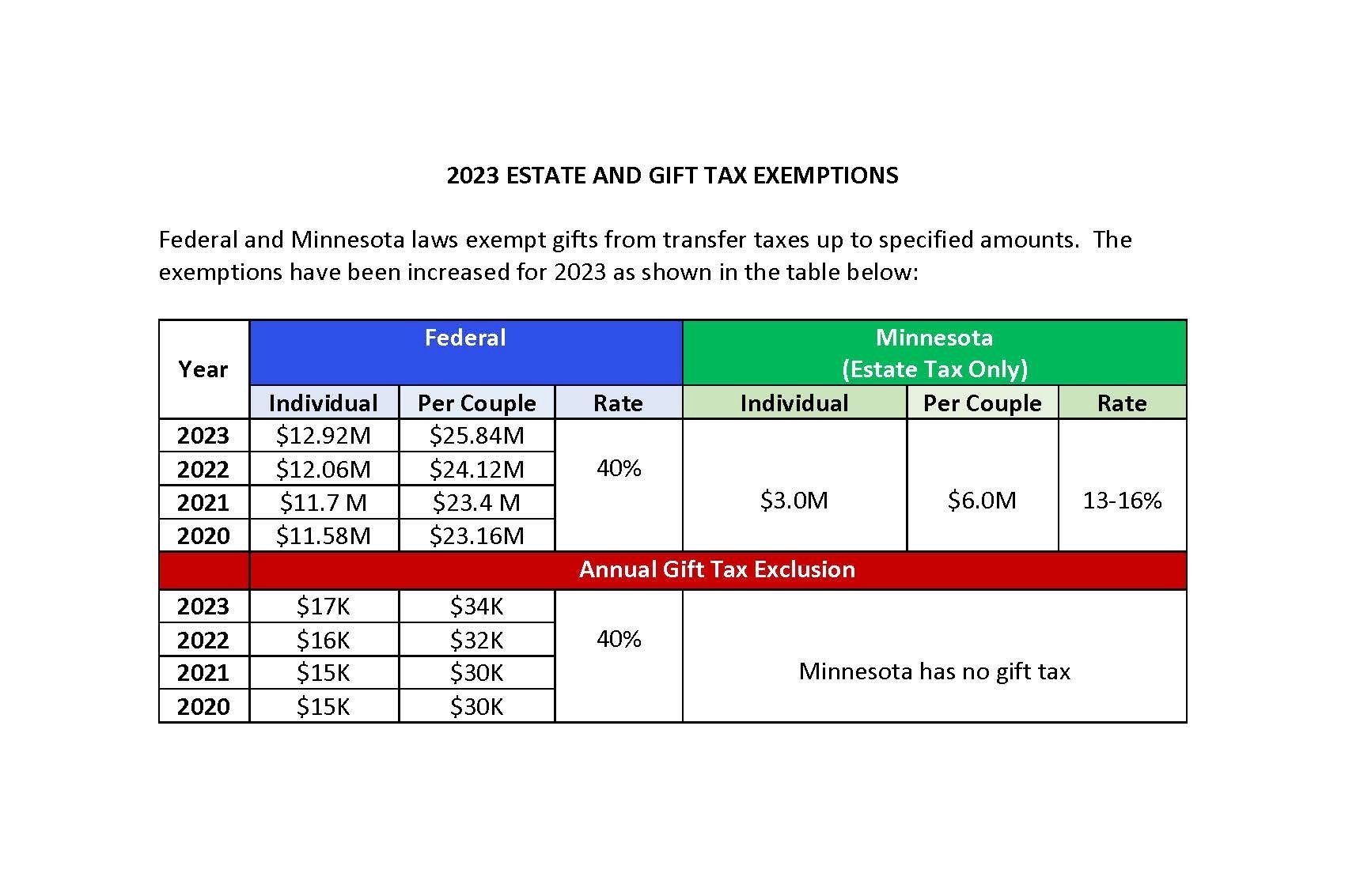

The combined gift and estate tax exemption will be $13.61 million per individual for lifetime gifts made in 2025.

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2025).

Federal Estate Tax Rates 2025 Norah Annelise, Starting on january 1, 2025, the annual exclusion on gifts will be $18,000 per recipient (up from $17,000 in 2025). The tax cuts and jobs act delivered a sizable increase in the tax exemption limit for estates and lifetime gifts — up to $13.61 million per person in 2025.

Gift and Estate Tax Exemption Limits Increase for 2025 Gold Leaf, These gifts can include cash as well as other. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayer’s lifetime exemption.

Updated Federal Estate and Gift Tax Exemptions for 2025, Spouses can elect to “split” gifts,. Fm nirmala sitharaman presented the modi 3.0 govt's budget today, introducing increased standard deduction and revised tax rates for salaried.

Burkhalter Law 2025 Tax Update Key Changes to Gift and Estate Tax, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). Effective january 2025, the federal estate & gift tax exemption is slated to increase by $690,000, reaching $13,610,000 per person (compared to the 2025 exemption of.

US Gift & Estate Taxes 2025 Gifts, Transfer Taxes HTJ Tax, Spouses can elect to “split” gifts,. In theory, you could give your daughter and her spouse $36,000 in 2025, and transfer up to $13.61 million in additional assets without having to worry about the gift tax.

What Is the 2025 and 2025 Gift Tax Limit? Ramsey, There's no limit on the number of individual gifts that can be. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted.

.jpg)

Unified Gift And Estate Tax Exemption 2025 Joan Maryanne, The 2025 lifetime federal gift and estate tax exemption update brings significant changes that can impact your estate planning strategy. Finance minister nirmala sitharaman announced a host of measures for taxpayers in budget 2025.

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, Finance minister nirmala sitharaman announced a host of measures for taxpayers in budget 2025. For 2025, the annual gift tax limit is $18,000.

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png)

2025 Estate Tax Exemption Dana Milena, Generally, the estate and gift tax exemption is used to determine the aggregate value of the taxable gratuitous transfers that a person. The new year inevitably brings changes to the federal estate tax exemption and gift tax exemption amounts, which continue to rise with inflation.